Have you ever checked your credit card statement and spotted a mysterious charge labeled "Quicktag Tempe AZ"? If so, you’re not alone. This charge can leave many people scratching their heads, wondering what it’s all about.

What is Quicktag Tempe AZ Charge on Credit Card?

A Quicktag Tempe AZ charge may be connected to a product purchase, an ID tagging service, or even a subscription. Some businesses process payments under names different from their public brand, which can make identifying the source of the charge confusing. However, this label can also appear if there’s an error or unauthorized transaction.

In today’s fast-paced world of digital transactions, it’s common for credit card charges to appear unfamiliar at first glance. But understanding where a charge comes from is vital to keeping your finances safe.

Why is quicktag tempe az charge on credit card?

Seeing this charge on your credit card can happen for several reasons.

For one, it might be the billing name of a merchant you purchased from recently. Many businesses, especially smaller ones, operate under one name but process credit card payments under another. This is a frequent cause of confusion for cardholders.

Another possibility is an accidental or duplicate transaction. Have you made a similar purchase recently? Sometimes, glitches or errors in the payment system can result in unexpected charges.

Unfortunately, unauthorized charges are also a potential reason. Fraudulent activity can lead to suspicious transactions appearing on your statement.

No matter the cause, identifying why a Quicktag Tempe AZ charge is on your card is an essential first step to protecting your credit and account balance.

How to Resolve a quicktag tempe az charge on Your Credit Card?

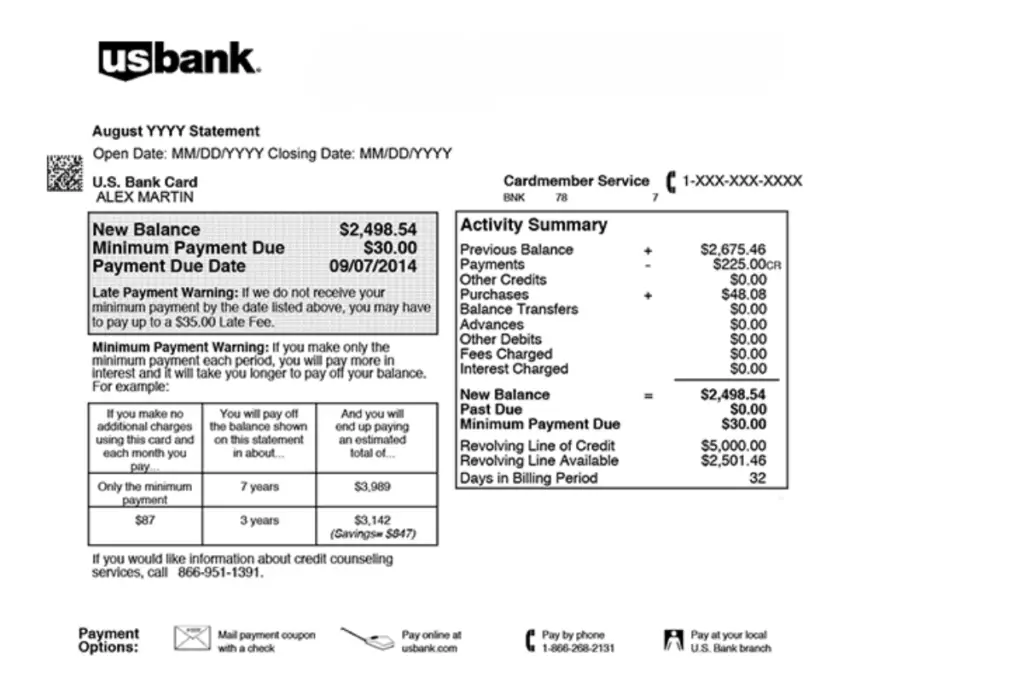

Resolving this charge starts with verification. Double-check your transaction history and any receipts for recent purchases. Compare the charge details, including the date and amount, to see if they align.

If the charge remains unrecognized, contact your credit card issuer. Most credit card companies have a dedicated team to handle disputes. They can provide more details about the charge, including the merchant’s contact information.

For unauthorized charges, file a formal dispute. Your credit card issuer will investigate the claim and, in many cases, refund the charge while the matter is resolved.

How to Prevent Futurequicktag tempe az charge on Your Credit Card?

Preventing these surprises starts with diligent credit card management.

- Monitor Your Statements: Regularly check your credit card and bank account activity. Catching unusual charges early can help you act quickly.

- Limit Card Access: Keep your card information private. Avoid sharing it with others, including family members, unless absolutely necessary.

- Secure Online Payments: Use secure payment platforms or virtual cards when shopping online to reduce the risk of fraud.

- Track Subscriptions: Keep a list of active subscriptions, so you’ll always know when to expect recurring charges.

By taking these precautions, you can reduce the likelihood of unexpected charges appearing on your credit card.

Conclusion on quicktag tempe az charge on credit card

Spotting a Quicktag Tempe AZ charge on your credit card doesn’t have to be stressful. It’s often just a matter of verifying the transaction’s source. Whether it’s a legitimate purchase or an unauthorized charge, knowing what to do and how to prevent future occurrences is key to maintaining your financial health.

Stay vigilant, review your statements regularly, and don’t hesitate to contact your credit card issuer whenever something seems off. A proactive approach ensures your credit remains secure, your account balance stays accurate, and your peace of mind is intact.