Brent Crude Oil, a benchmark for global oil prices, plays a pivotal role in the energy markets and the broader economy. Trading this commodity effectively requires a solid understanding of market dynamics, including the factors driving price changes, optimal trading times, and the best platforms and strategies to use. This guide will walk you through essential aspects of trading Brent Crude Oil, offering insights into market influences, trading hours, and practical tips for both seasoned and novice traders.

1. Understanding Brent Crude Oil and Its Trading Symbol

What is Brent Crude Oil?

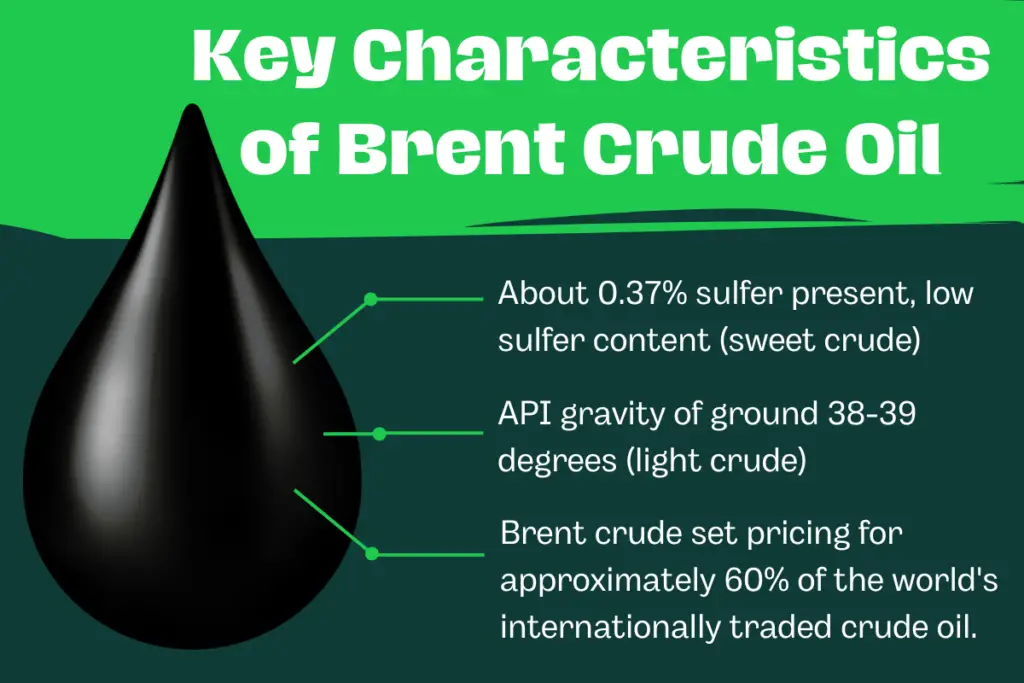

Brent Crude Oil is one of the major benchmarks for oil prices worldwide. It is a light, sweet crude oil sourced from the North Sea and is used to price nearly two-thirds of the world’s internationally traded crude oil supplies. Its characteristics make it ideal for refining into petrol and middle distillates like diesel and kerosene.

- Understanding Brent Crude Oil is essential for traders as it represents the standard price against which other crude oils are measured. It’s highly sought after due to its low sulfur content and density.

The Importance of the Brent Crude Trading Symbol (BRN)

The trading symbol “BRN” is used on financial exchanges to represent Brent Crude Oil futures contracts. Recognizing and understanding this symbol is crucial for traders who wish to track and trade Brent Crude effectively.

2. How Brent Crude Oil is Traded

Overview of Brent Crude Oil Trading

Brent Crude Oil trading involves the buying and selling of futures contracts or other financial instruments that derive their value from the price of Brent Crude Oil. Traders participate in these markets to speculate on price movements or to hedge against price risks.

- Key Players: The market includes various participants such as speculators, hedgers, institutional investors, and retail traders. Understanding the role of each participant helps in identifying market trends and potential trading opportunities.

- Role: Speculators are traders who aim to profit from price fluctuations in the Brent Crude Oil market. They typically do not have any intention of taking physical delivery of the oil but instead buy and sell futures contracts based on their predictions of future price movements.

- Impact on the Market: Speculators provide liquidity to the market, making it easier for other participants to enter and exit positions. Their trading activities can also amplify price movements, especially during periods of high market volatility.

- Role: Hedgers are participants who engage in Brent Crude trading to protect themselves against adverse price movements. They are usually producers, refiners, or consumers of crude oil who use futures contracts to lock in prices and mitigate the risk of price fluctuations.

- Impact on the Market: Hedgers help stabilize the market by reducing the impact of unexpected price changes on their operations. Their activities can provide insights into future market conditions, as they are often closely tied to real-world supply and demand dynamics.

- Role: Institutional investors, such as hedge funds, mutual funds, and pension funds, invest in Brent Crude Oil to diversify their portfolios or as part of a broader commodity strategy. They often have significant capital and can take both long and short positions.

- Impact on the Market: Institutional investors can influence market trends due to the large volume of their trades. Their investment decisions are often based on macroeconomic factors, technical analysis, and geopolitical events, which can affect market sentiment and drive price movements.

- Role: Retail traders are individual investors who trade Brent Crude Oil through online trading platforms. They participate in the market for speculative purposes or as part of a broader investment strategy.

- Impact on the Market: Although retail traders typically have less capital compared to institutional investors, their collective trading activities can contribute to market liquidity and, in some cases, influence short-term price trends, especially during periods of heightened market activity or news events.

Brent Crude Oil Trading Economics

The economics of Brent Crude Oil trading are influenced by several factors, including global supply and demand, geopolitical tensions, OPEC production decisions, and economic indicators such as GDP growth rates and inflation. These factors can cause significant volatility in the Brent Crude market.

- Market Dynamics: Insight into the factors affecting oil prices, such as production cuts or increases by OPEC, geopolitical conflicts, and technological advancements in oil extraction and alternative energies, provides traders with valuable information for making informed trading decisions.

How is Brent Oil Traded?

Brent Oil is primarily traded through futures contracts on exchanges like the Intercontinental Exchange (ICE) and the New York Mercantile Exchange (NYMEX). These contracts specify the quantity of oil to be delivered or received at a future date and price.

Trading Instruments: Traders can also use options, swaps, and CFDs (Contracts for Difference) to gain exposure to Brent Crude Oil prices. Each instrument has its advantages and is suited for different trading strategies.

Trading Process: To trade Brent Oil, a trader typically selects a trading platform, monitors market conditions, places orders (buy or sell), and manages positions based on market movements and their risk tolerance.

3. Key Factors Affecting Brent Crude Oil Prices

Key Factors Affecting Brent Crude Oil Prices

1. OPEC+ Meetings

- Impact on Brent Crude Oil: OPEC+ meetings are significant as they involve major oil-producing countries making decisions about oil production quotas. An agreement to cut production typically leads to higher Brent Crude prices due to anticipated reduced supply. Conversely, an increase in production quotas can lead to lower prices.

- Price Movement:

- Production Cuts: Prices go up.

- Production Increases: Prices go down.

- Buy or Sell:

- Production Cuts: Buy Brent Crude, as reduced supply often leads to higher prices.

- Production Increases: Sell Brent Crude, as increased supply can lead to lower prices.

- Reason: Supply adjustments by major producers directly influence global oil prices.

2. U.S. Energy Information Administration (EIA) Weekly Crude Oil Inventories Report

- Impact on Brent Crude Oil: The EIA report provides data on U.S. crude oil inventory levels. A larger-than-expected inventory build suggests weaker demand or overproduction, leading to lower Brent Crude prices. Conversely, a drawdown in inventories indicates higher demand or reduced supply, pushing prices up.

- Price Movement:

- Inventory Build: Prices go down.

- Inventory Drawdown: Prices go up.

- Buy or Sell:

- Inventory Build: Sell Brent Crude, as increasing inventories suggest lower demand or oversupply.

- Inventory Drawdown: Buy Brent Crude, as decreasing inventories indicate higher demand or reduced supply.

- Reason: Inventory levels reflect the balance of supply and demand, impacting price levels.

3. Geopolitical Tensions (e.g., Middle East Conflicts)

- Impact on Brent Crude Oil: Geopolitical events, especially in key oil-producing regions like the Middle East, can disrupt oil production and transportation, leading to higher Brent Crude prices due to fears of supply shortages.

- Price Movement: Prices go up.

- Buy or Sell: Buy Brent Crude, as geopolitical risks often drive prices higher.

- Reason: Geopolitical uncertainties can lead to supply disruptions, increasing prices due to reduced availability.

4. U.S. Sanctions on Oil-Producing Countries (e.g., Iran, Venezuela)

- Impact on Brent Crude Oil: U.S. sanctions on major oil producers like Iran or Venezuela can reduce global oil supply, leading to higher Brent Crude prices. The market reacts to the potential for decreased production and export volumes from these countries.

- Price Movement: Prices go up.

- Buy or Sell: Buy Brent Crude, as sanctions typically tighten supply and push prices higher.

- Reason: Sanctions can lead to reduced oil production and export volumes, impacting global supply and driving up prices.

5. Natural Disasters (e.g., Hurricanes in the Gulf of Mexico)

- Impact on Brent Crude Oil: Natural disasters affecting oil production or refining infrastructure can disrupt supply, leading to higher Brent Crude prices. For example, hurricanes in the Gulf of Mexico can halt production and refining activities.

- Price Movement: Prices go up.

- Buy or Sell: Buy Brent Crude, as the potential for supply disruptions can lead to higher prices.

- Reason: Natural disasters can damage infrastructure and halt production, leading to reduced supply and higher prices.

6. Global Economic Data (e.g., U.S. GDP, China Manufacturing Data)

- Impact on Brent Crude Oil: Strong global economic data, such as robust U.S. GDP growth or high manufacturing activity in China, can boost oil demand and drive up Brent Crude prices. Weak economic data can suggest lower future demand, leading to price declines.

- Price Movement:

- Strong Data: Prices go up.

- Weak Data: Prices go down.

- Buy or Sell:

- Strong Data: Buy Brent Crude, as increased economic activity usually leads to higher oil demand.

- Weak Data: Sell Brent Crude, as weaker economic conditions can reduce oil demand.

- Reason: Economic growth affects energy consumption and oil demand, influencing prices.

4. Brent Crude Oil Trading Hours and Best Times to Trade

Trading Hours for Brent Crude Oil

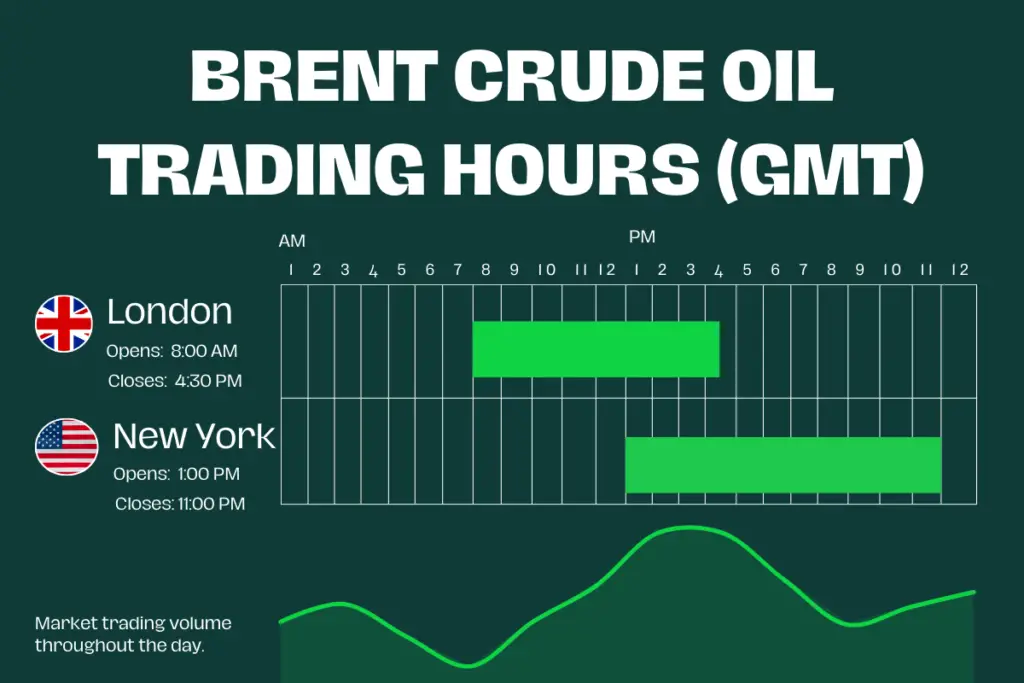

Brent Crude Oil is traded on various exchanges around the world, with specific trading hours depending on the exchange and market. The primary exchange for Brent Crude is the Intercontinental Exchange (ICE), where Brent Crude futures contracts are traded.

- ICE Trading Hours:

- Open: 01:00 (PM) GMT

- Close: 11:00 (PM) GMT

- Note: Trading hours may vary slightly due to daylight saving time changes and other factors.

- Market Overlaps: Brent Crude Oil trading is also influenced by the trading hours of other major financial centers, including New York and London. Market overlaps can create higher liquidity and more trading opportunities.

- New York Trading Hours: 01:00 GMT to 09:00 GMT

- London Trading Hours: 08:00 GMT to 04:30 GMT

- Considerations: Traders should be aware of the most active trading hours and market overlaps to maximize liquidity and reduce trading costs.

Best Time to Trade Crude Oil

The best times to trade Brent Crude Oil are during the overlap between the London and New York trading sessions, typically from 01:00 GMT to 04:30 GMT, when market activity and liquidity are at their peak.

- Optimal Times:

- Overlap Between London and New York Sessions: The period between 01:00 GMT and 04:30 GMT is generally the best time to trade Brent Crude Oil due to increased market activity and liquidity. This overlap includes both London and New York trading hours, leading to higher trading volumes and more volatile price movements.

- Economic Data Releases: Trading can be more active around major economic data releases, such as U.S. inventory reports or OPEC meetings. These events can cause significant price swings and present trading opportunities.

- You should also consider the impact of global news and geopolitical events mentioned previously, as these can influence market conditions and create trading opportunities at various times throughout the day.

Choosing the Right Crude Oil Trading Platform and Strategies

Popular Crude Oil Trading Platforms

- MetaTrader 4/5 (MT4/MT5): Widely used for trading various assets, including crude oil. Offers robust charting tools, technical indicators, and automated trading capabilities.

- Interactive Brokers: Known for its comprehensive trading tools and access to global markets, including crude oil futures and options.

- TD Ameritrade: Provides a user-friendly platform with advanced trading features and research tools suitable for both beginners and experienced traders.

- eToro: Popular for its social trading features, allowing traders to follow and copy the strategies of experienced investors.

Strategies for Trading Brent Crude Oil

- Trend Following: Identify and follow the direction of the prevailing market trend. Use moving averages and trend lines to make trading decisions.

- Swing Trading: Take advantage of short-term price fluctuations by entering trades at key support or resistance levels and exiting when the price reverses.

- Breakout Trading: Trade when the price breaks through key support or resistance levels, anticipating a continuation of the move.

- Fundamental Analysis: Base trading decisions on economic indicators, geopolitical events, and supply-demand dynamics to predict price movements.

Tips for Beginners on How to Trade Crude Oil

- Start Small: Begin with a demo account or small trades to get familiar with market conditions and trading platforms.

- Educate Yourself: Learn about crude oil markets, trading strategies, and technical analysis to make informed decisions.

- Manage Risk: Use stop-loss orders and only risk a small percentage of your trading capital on each trade to protect against significant losses.

- Stay Informed: Keep up with news and events that impact oil prices, such as geopolitical developments and economic data releases.

By choosing the right trading platform and employing effective strategies, beginners can enhance their trading experience and improve their chances of success in the Brent Crude Oil market.

Conclusion

Trading Brent Crude Oil requires a nuanced understanding of various factors that influence its price movements and choosing the right strategies and tools. Key drivers such as geopolitical events, supply and demand dynamics, economic indicators, and global news significantly impact Brent Crude Oil prices, creating both opportunities and risks for traders.

Geopolitical influences, such as conflicts in major oil-producing regions and international sanctions, can lead to substantial price fluctuations by affecting supply levels. Similarly, supply and demand dynamics, including decisions by OPEC+ and inventory reports, directly influence price movements by altering the balance of global oil supply and demand. Economic indicators and natural disasters also play critical roles, affecting market sentiment and oil production capabilities.

Understanding the optimal trading hours, particularly the overlap between London and New York sessions, and the impact of economic data releases can enhance trading strategies. Utilizing platforms like MetaTrader, Interactive Brokers, TD Ameritrade, and eToro can provide traders with the necessary tools and resources to effectively analyze and trade Brent Crude Oil. Employing strategies such as trend following, swing trading, breakout trading, and fundamental analysis can help in making informed trading decisions.

For beginners, starting with small trades, educating oneself about the market, managing risk carefully, and staying informed about market developments are essential steps to achieving success in crude oil trading. By integrating these insights and strategies, traders can navigate the complexities of the Brent Crude Oil market, optimize their trading practices, and capitalize on market opportunities.